Your competitors just figured out what you’re about to read.

While you’ve been fighting for scraps in oversaturated Western markets—bidding $47 per click for keywords with difficulty scores approaching 80—a quiet land grab is happening in Africa. And it’s not what you think.

Africa’s internet economy will hit $180 billion by 2025. Yet 78% of African businesses still operate without basic SEO implementation. Translation: the SEO landscape across Nigeria, Kenya, South Africa, and Ghana looks exactly like the United States did in 2008.

Low competition. High intent. Exploding search volume.

The keyword “how to get a loan” has a difficulty score of 12 in Kenya versus 58 in the UK. Same search. Same intent. 18,000 monthly searches. But in Kenya, you’re not competing against every fintech company with a seven-figure marketing budget.

You’re probably thinking: “Africa? That’s too risky. Too complicated. Too different.”

That’s exactly what everyone said about Southeast Asia in 2012. Then about Latin America in 2016. The brands that moved early in those markets didn’t just grow—they dominated before the competition even woke up.

The SEO Gold Rush Nobody Sees Coming

Here’s what’s actually happening on the ground across African markets right now.

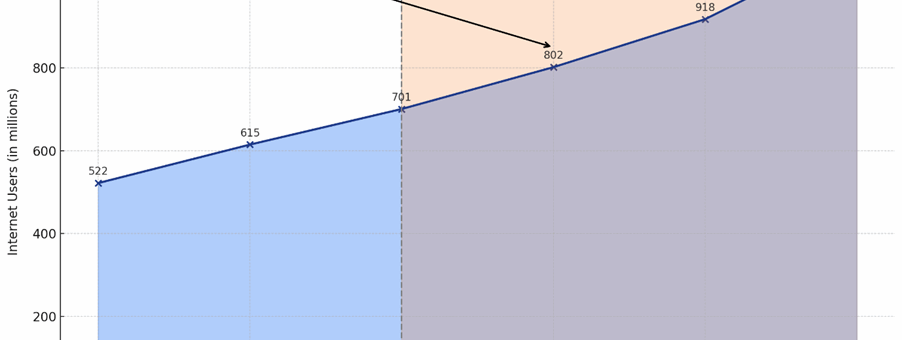

Nigeria has 122 million internet users. Kenya has 46 million. South Africa has 38 million. Ghana has 15 million. And those numbers are growing at 15-20% annually—five times faster than mature markets.

But here’s the kicker: organic search still dominates user acquisition in these markets. Social media advertising costs are rising faster than in Western markets due to increased competition, but SEO remains massively underutilized.

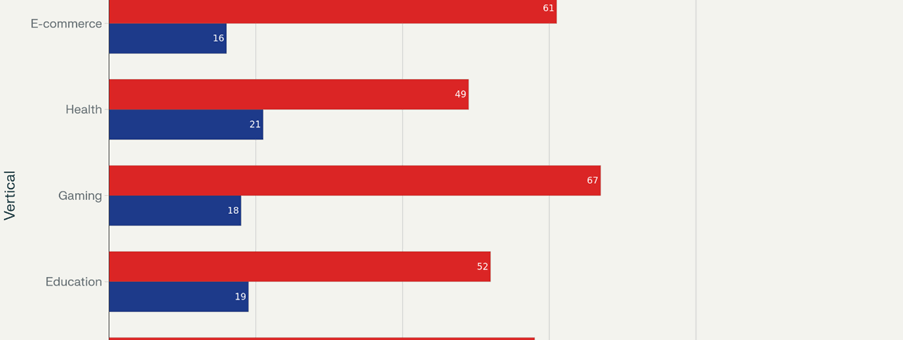

The numbers tell a story most marketers miss:

Search volume for fintech terms in West Africa is climbing 40% year-over-year. Online education queries in Francophone Africa jumped 55% in just twelve months. Gaming-related searches in Nigeria surged 70% annually.

These aren’t small niches. We’re talking about sectors worth billions, with search demand exploding, and keyword difficulty scores that would make any SEO professional in London or New York weep with envy.

A recent analysis of 50,000 keywords across six African markets revealed something startling: average keyword difficulty in finance, health, and education sectors runs 55% lower than equivalent terms in the US and UK markets.

Let me give you a concrete example. “Best mobile games” in Nigeria: 22,000 monthly searches, keyword difficulty of 18. Same query in the United States: 201,000 monthly searches (yes, higher volume), but keyword difficulty of 71. The US market has 9x the volume but 4x the difficulty—meaning the actual opportunity (volume divided by competition) is substantially better in Nigeria.

But low competition alone doesn’t make a market attractive.

You need intent. You need buying power. You need infrastructure.

Why 99% of Companies Completely Botch African SEO

Most international brands treat Africa like a single market. It’s not.

Africa comprises 54 countries, thousands of languages, and dramatically different digital ecosystems. Lumping Nigeria and Mozambique together makes about as much sense as treating Germany and Turkey as the same market because they’re both “in Europe.”

Yet this is exactly what happens. Companies either ignore Africa entirely or launch half-hearted, one-size-fits-all campaigns that fail spectacularly.

Here are the three fatal mistakes we see repeatedly:

Mistake 1: Ignoring Language Complexity

English dominates in Nigeria, Kenya, Ghana, and South Africa. French dominates in Côte d’Ivoire, Senegal, Cameroon, and the DRC. Portuguese rules in Mozambique and Angola. Swahili, Arabic, Hausa, Zulu, Amharic—the list goes on.

But here’s what companies miss: even in officially English-speaking countries, local language search behavior differs dramatically.

“How do I get a personal loan” might be standard in the UK. In Nigeria, users search “how to borrow money fast” or “quick loan without collateral.” In Kenya, “mobile loans no CRB” dominates. Same intent. Completely different keywords.

The brands winning in these markets aren’t translating—they’re transcreating. They’re researching actual local search behavior rather than assuming US/UK keywords will work.

Mistake 2: Assuming Low Competition Means Low Value

Silicon Valley VCs poured $6.5 billion into African startups in 2023. That money isn’t funding charitable causes—it’s chasing massive returns.

The lifetime value of a fintech customer in Kenya might be lower in absolute dollar terms than in Germany. But the customer acquisition cost is 73% lower. The payback period is shorter. The growth rate is exponential.

We’ve seen iGaming operators acquire customers in Ghana for $8 versus $156 in the UK. Yes, the average deposit is smaller. But when your CAC drops by 95%, you can afford to optimize for volume and still hit better unit economics than mature markets.

Mistake 3: Neglecting Mobile-First Reality

Over 80% of African internet traffic comes from mobile devices. Not 51% like in Western markets—over 80%.

If your site isn’t genuinely mobile-optimized, you’ve already lost. And no, I don’t mean “responsive design.” I mean optimized for 3G connections. Optimized for devices with limited processing power. Optimized for users who’ve never touched a desktop computer.

Page speed becomes absolutely critical. A site that loads in 4.5 seconds in London might take 15 seconds in Lagos on a typical connection. Every second of load time costs you conversions.

Google’s Core Web Vitals aren’t nice-to-have suggestions in African markets—they’re make-or-break fundamentals.

The Sector-by-Sector Breakdown: Where the Real Money Lives

Not all African markets offer equal opportunity. Smart operators segment by vertical and geography.

Fintech and Mobile Lending

This is the gold mine. The absolute gold mine.

Keywords around loans, mobile money, savings, and investment explode with search volume but remain relatively easy to rank for. “Mobile loans Kenya” gets 14,000 monthly searches with a KD of just 8. “Loan apps Nigeria” pulls 18,500 searches monthly with KD of 11.

For comparison, “personal loans” in the United States has a KD of 79.

M-Pesa’s success proved that Africans will adopt financial services that meet their needs. Now dozens of challengers are fighting for market share, and SEO represents one of the most cost-effective acquisition channels available.

Online Education and Certification

The hunger for online education in Africa is staggering. “Online courses Nigeria” sees 8,200 monthly searches (KD 15). “Study abroad scholarships Nigeria” hits 25,000+ monthly searches with KD below 20.

The African e-learning market is projected to grow at 16% annually through 2028. Students are actively searching. They’re motivated. They’re qualified leads.

Yet educational institutions and course platforms largely ignore African SEO. The top-ranking results for many education queries are barely optimized, outdated sites that would get crushed in competitive Western SERPs.

iGaming and Sports Betting

This is Leverage’s specialty, so let’s be direct: African iGaming markets are exploding.

Nigeria’s sports betting market hit $2 billion in 2023. Kenya’s market topped $1.3 billion. South Africa’s established gambling market continues growing online. Ghana’s licensing framework is attracting international operators.

Search volume for betting-related terms grows 30-40% annually. “How to bet on football Nigeria” pulls 6,700 monthly searches with KD of just 9. “Best betting sites Kenya” gets 4,300 searches monthly, KD 12.

Operators entering these markets early with proper SEO strategies are capturing market share that will compound for years. Late entrants will face the same challenge they face in saturated European markets—fighting for scraps.

E-commerce and Marketplace

Jumia, Africa’s largest e-commerce platform, serves over 600 million people across 11 countries. But Jumia isn’t Amazon—there’s still massive opportunity for vertical-specific and niche e-commerce plays.

“Buy phones online Nigeria” gets 12,000 monthly searches (KD 21). “Cheap laptops South Africa” pulls 5,400 searches (KD 18). These aren’t astronomical volumes, but the conversion potential is high and the competition is beatable.

Healthcare and Telemedicine

COVID accelerated telemedicine adoption across Africa. Now patients actively search for online healthcare services, pharmaceutical delivery, and medical information.

“Telemedicine Kenya” gets 1,900 searches monthly (KD 14). “Online pharmacy Nigeria” pulls 8,100 searches (KD 19). As healthcare infrastructure develops and more services move online, these numbers will multiply.

The Geographic Playbook: English vs. French vs. Portuguese Markets

Not all African markets are created equal for SEO. Here’s how to think about geographic strategy.

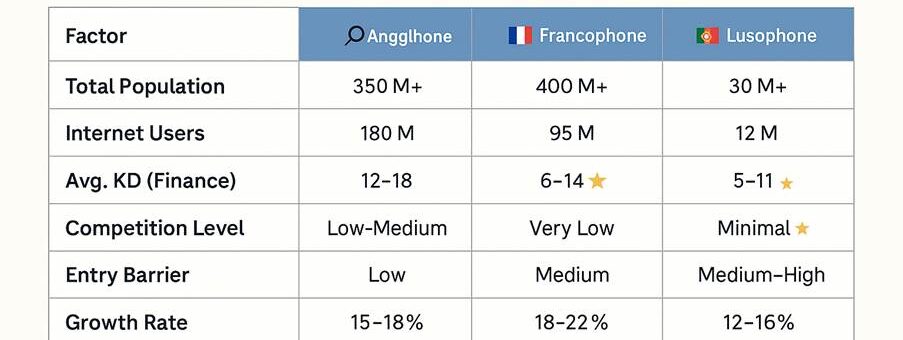

Anglophone Africa: The Immediate Opportunity

Nigeria, Kenya, South Africa, Ghana, and Uganda comprise the largest English-speaking markets in Africa. Combined population: over 350 million. Total internet users: approximately 180 million and growing.

These markets offer the lowest barrier to entry for English-speaking operators. Content can be adapted from existing English assets, though localization remains critical for success.

Nigeria dominates by sheer size—with 122 million internet users, it’s the largest digital market in Africa. But don’t sleep on Kenya, which punches above its weight in fintech and mobile innovation, or South Africa, which offers the highest GDP per capita and most developed digital infrastructure.

Francophone Africa: The Overlooked Goldmine

Côte d’Ivoire, Senegal, Cameroon, DRC, Mali, Madagascar—Francophone Africa comprises 29 countries with over 400 million people and represents one of the fastest-growing internet markets globally.

Yet English-speaking companies almost universally ignore it.

This creates a massive arbitrage opportunity for operators willing to develop French-language strategies. Keyword difficulty in Francophone markets runs even lower than Anglophone markets because international competition is virtually nonexistent.

“Comment obtenir un prêt” (how to get a loan) in Senegal: 3,200 monthly searches, KD of just 6. “Meilleurs sites de paris” (best betting sites) in Côte d’Ivoire: 2,800 searches, KD of 8.

The catch: you need genuinely French content, not Google-translated English. You need to understand regional French variations. And you need localized strategies for each market.

Lusophone Africa: The Long Game

Mozambique, Angola, and Guinea-Bissau speak Portuguese. Smaller markets, less developed digital infrastructure, but growing fast and virtually ignored by international operators.

If you’re already operating in Brazil, Lusophone Africa offers natural expansion possibilities. The language barrier protects these markets from English-speaking competitors.

The Professional Framework: How to Actually Win in African SEO

Enough context. Let’s talk execution.

Winning in African markets requires a different playbook than Western SEO. Here’s the framework we use at Leverage for clients entering these markets.

Phase 1: Market Intelligence and Keyword Research

You cannot skip research. You cannot assume. You cannot guess.

Start with actual data from Ahrefs, SEMrush, or your preferred SEO tool. But don’t stop there—these tools have incomplete data for many African markets.

Supplement with:

- Google Keyword Planner (still valuable for volume estimates)

- Google Trends (understand seasonality and growth)

- Reddit and Facebook groups (discover actual language patterns)

- Local forums and Q&A sites (understand real pain points)

- Competitor analysis (what’s already ranking?)

Build comprehensive keyword maps segmented by:

- Search intent (informational, commercial, transactional)

- User journey stage (awareness, consideration, decision)

- Geographic market (Nigeria vs. Kenya vs. Ghana)

- Language (English variants, French, Portuguese, local languages)

Phase 2: Technical Foundation

Mobile-first isn’t optional. It’s existential.

Optimize for:

- Page speed under 3 seconds on 3G connections

- Minimal JavaScript (many African devices struggle with heavy JS)

- Compressed images (data costs matter to users)

- AMP or other speed frameworks

- Progressive Web App capabilities

- Offline functionality where possible

Set up proper technical SEO infrastructure:

- Clean URL structures

- Proper hreflang tags for multi-country/language targeting

- Schema markup (especially for local business, FAQs)

- XML sitemaps

- Robots.txt optimization

- SSL/HTTPS (non-negotiable)

Phase 3: Content Localization

Transcreation, not translation.

Work with native speakers who understand local digital behavior. They should:

- Adapt keyword usage to local search patterns

- Incorporate local cultural references

- Address local pain points and objections

- Use locally relevant examples

- Understand local regulatory requirements

Create content clusters around:

- Money keywords (commercial intent)

- Educational content (building trust)

- Comparison content (capturing decision-stage users)

- Local news/trends (relevance and timeliness)

Phase 4: Link Building and Authority Development

Traditional link building works differently in African markets.

High-authority local domains are scarce. Major international news sites rarely link to African content unless it’s newsworthy. The link graph looks nothing like Western markets.

Focus on:

- Digital PR in local publications

- Partnerships with local organizations

- Directory submissions (still valuable here)

- Social signals (more important than in mature markets)

- Guest posting on relevant local blogs

- Building relationships with local influencers

Phase 5: Conversion Optimization

Traffic without conversion is vanity metrics.

Optimize for African user behavior:

- Multiple payment options (mobile money, bank transfer, cards)

- Trust signals (local testimonials, local payment logos)

- Clear pricing in local currency

- WhatsApp integration (primary communication channel)

- Minimal form fields (mobile typing is painful)

- Progressive disclosure (don’t overwhelm users)

The Economics: Why This Beats Saturated Western Markets

Let’s talk numbers. Real numbers from real campaigns.

A European iGaming operator spent €156 average CAC in the UK through paid channels. SEO helped, but organic CAC still ran €47 when you factor in content costs, technical work, and link building.

Same operator, Ghana market: €8 CAC through organic search. Same business model. Same service. 94% lower acquisition cost.

Yes, average customer LTV in Ghana is lower—about 62% of UK levels. But when you’re paying 94% less to acquire, the unit economics are dramatically better. Payback period dropped from 8 months to 6 weeks.

Another example from fintech:

A mobile lending app targeting “personal loan” keywords in the UK faced keyword difficulty of 72. They needed massive backlink profiles, huge content investments, and even then struggled to crack page one.

Same app, Kenya market: “mobile loans Kenya” had KD of 8. They reached position 3 within 45 days. Position 1 within 4 months. With a fraction of the investment.

The arbitrage opportunity exists because:

- Competition hasn’t arrived yet. International players are focused on Western markets or East Asia. Local African companies lack SEO sophistication.

- Infrastructure is rapidly improving. Internet penetration, payment systems, and smartphone adoption are hitting critical mass.

- Search behavior is maturing. Users are moving beyond social media to active search for solutions.

- First-mover advantages compound. Early domain authority, brand recognition, and backlink profiles create lasting competitive moats.

But here’s the critical insight: this window won’t last forever.

In Southeast Asia, keyword difficulty scores in major markets like Indonesia, Thailand, and Vietnam have roughly doubled since 2018 as international operators discovered the opportunity. The same thing will happen in Africa—it’s already beginning in Nigeria and Kenya.

The question isn’t whether you should enter African markets. The question is whether you want to enter now when the opportunity is wide open, or in three years when you’re fighting the same competitive battles you face in Western markets today.

Real Talk: The Challenges Nobody Mentions

I’m not going to pretend African SEO is easy. It’s not.

Challenge 1: Data Gaps

SEO tools provide less accurate data for African markets. Search volume estimates can be off. Keyword difficulty scores might not capture local competition. You need to validate everything.

Challenge 2: Payment and Monetization Complexity

Different countries have different payment ecosystems. What works in Kenya (M-Pesa) doesn’t exist in Nigeria (OPay, PalmPay, bank transfers). You need localized payment integration.

Challenge 3: Regulatory Uncertainty

Regulations around iGaming, fintech, healthcare, and other verticals vary widely and can change rapidly. You need local legal expertise.

Challenge 4: Infrastructure Variability

Internet speeds, electricity reliability, and device capabilities vary dramatically. What works in Lagos might struggle in rural areas.

Challenge 5: Talent and Expertise

Finding SEO professionals with deep African market knowledge is challenging. Most agencies offering “African SEO” have never actually worked in these markets.

This is precisely why the opportunity exists. If it were easy, everyone would be doing it.

Your Competitive Advantage: Move Now or Watch from the Sidelines

Let me be brutally honest with you.

Everything I’ve shared in this article will be common knowledge within 24 months. The SEO conferences already feature African market panels.

By then, keyword difficulty scores will have climbed. The easy wins will be gone. You’ll be fighting for the same competitive scraps you’re fighting for now in Western markets.

The brands that will dominate African digital markets in 2030 are making their moves right now in 2025 and 2026.

Are you one of them?

Tactical Takeaways: Your Action Plan

You’ve read this far, which means you’re seriously considering African market expansion. Good.

Here’s what separates companies that succeed from those that waste resources:

Successful companies don’t try to DIY their entry into unfamiliar markets. They partner with experts who’ve navigated these waters before. They invest properly in research, strategy, and localization. They commit to 12-month timelines rather than expecting instant results.

Unsuccessful companies cut corners. They Google Translate content. They assume Western strategies will work. They expect results in 90 days. They give up when the easy button doesn’t exist.

Which approach will you take?

At Leverage, we’ve helped operators across sports betting, casino, and Web3 enter African markets strategically. We’ve run SEO sites in Nigeria, Kenya, South Africa, Ghana, and 8 more African countries. We understand the nuances that make or break success.

We’re not interested in small projects or companies looking for cheap SEO. Our market entry strategies start at €10,000, and full SEO services run $6,000+ monthly or 10-25% revenue share depending on the model.

But for companies serious about capturing African market share, the ROI makes the investment obvious.

Here’s my challenge to you:

Feel free to drop us a message with your biggest concern or question about African market entry.

We’ll personally respond to every substantive question

And if you’re ready to stop researching and start executing, let’s talk.

The SEO gold rush in Africa is happening. The only question is whether you’ll be part of it.

FAQs

Why should my business focus on African markets for SEO?

African digital markets offer explosive growth, low keyword difficulty, and untapped search intent — making them ideal for cost-effective SEO dominance

What are the best countries in Africa for SEO growth?

Nigeria, Kenya, South Africa, and Ghana lead for English SEO, while Côte d’Ivoire and Senegal present huge French-language opportunities.

How competitive is SEO in Africa compared to the US or UK?

Keyword difficulty in African markets can be up to 55% lower than in Western regions, allowing faster rankings with less investment.

What sectors in Africa offer the most SEO opportunity?

Fintech, iGaming, online education, e-commerce, and healthcare show the highest growth and search volume with minimal SEO saturation.

What’s the biggest mistake companies make with African SEO?

They treat Africa as one market. Winning requires localized strategies per country, language, and user behavior — not generic campaigns.

1 Comment

-

November 9, 2025 - 9:58 pm[…] marché africain affiche un fort potentiel : croissance rapide de l’usage internet et mobile. Leverage+2Kurious LTD+2La concurrence en SEO est souvent plus faible que sur les marchés matures, ce qui offre une […]